Payment Consulting for Payment Service Providers

Key Payment Expertise to support PSPs

Payment Service Providers face many continuous challenges as they need to provide high reliable performances and features in a continuously evolving environment.

Our team of payment consultants has spent more than a decade working with Payment Gateways and Acquirers, knowing first-hand daily challenges while needing to focus on:

◦ Providing new payment features and payment methods to merchants

◦ Answering to regulatory and compliance requirements such as PSD2, GDPR and AMLD5

◦ Building new innovative and smart products and features to attract new merchants and expand to new markets

Having worked in Commercial, Project and Product Management roles we can assist payment service providers with a wide range of topics.

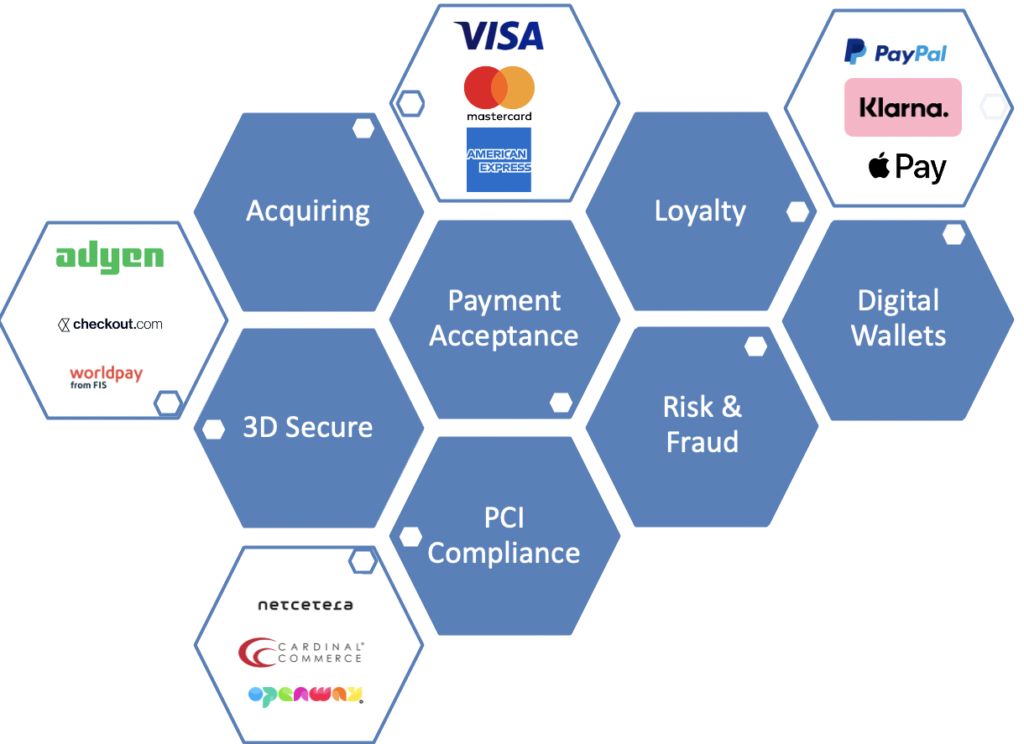

Payment Service Provider solutions

At Payment-Universe we have been working with merchants, payment service providers and issuers during the last years, managing products and operational processes related to payment authentication methods. We have been very familiar with solutions and strategies related to the established first 3D Secure version and we have been proactively involved into many projects related to the latest protocol introduced by EMVCo ( EMV 3DS).

Having a 360 degrees knowledge about payment authentication solutions, we can strategically guide you with:

◦ Optimisation of 3D Secure 2 (3DS2) authentication methods with gap analysis and market solution evaluations

◦ Product support with advanced authentication possibilities such as Delegated Authentication with FIDO;

◦ Selection of the right partners and solutions, evaluating the usage of third-party 3DS Servers

◦ We speed up your go-to market for SCA Smart Engine solutions to allow SCA optimisation and PSD2 SCA exemptions with full interim end-to-end product management

Payment Gateways and Acquirers are continuosly launching new solutions or defining new features as the payment industry is in constant movement. With our Product Management experience we can support with:

◦ Card Acceptance and Acquiring solutions

◦ Value Added Services and Loyalty products

◦ New Payment Methods

◦ Authentication and Risk Management products

Based on several years of experience and an advanced Data Analytics Suite we offer the possibility to outsource payment management and optimization monitoring to our team of experts. As a merchant you would benefit from:

◦ Advanced KPIs for a very detailed performance monitoring to optimize your transaction conversion rates;

◦ Payment performance benchmarking based on processing country, Merchant Category Code (MCC), Payment Gateway and Payment Methods;

◦ Payment and Risk Management expertise and insights about merchant, payment service providers and issuer best practices;

Learn more about “Your Payment Manager” service and start quickly to optimize your payment conversion.

Many Payment Service Providers provide great industry insights and information to assist their merchants and clients in having best-in-class payment management. Often external help and expertise is required to ensure high-quality results. We can support with:

◦ Market research and analysis

◦ Industry surveys involving payment professionals leveraging our payment network

◦ Case Studies and White-paper collaborations

Often payment service providers enter new markets or start to explore new strategies to increase their attractiveness and the business turnover. Leveraging our expertise and the support from our partners we can help with

◦ Finding ways to win and attract profitable customers

◦ Have efficient and successful Sales processes

◦ Sales strategy to enter new markets leveraging our network of payment professionals

Open Banking is not a pure “Fintech” or Banking as a Service topic. It brings a lot of new opportunities for Payment Service Providers as well. Our team has been engaged in already several projects leveraging open banking and we can support you with creating new solutions to:

◦ Improve end-consumer scoring leveraging eKYC and bank identifications

◦ Offer instant payments with Payment Initiation Service Providers

◦ Innovative solutions in partnerships with leading market AISPs and PISPs